Simple Ways to Send Money on Cash App: Updated for 2025

In today’s digital age, send money on Cash App has become an essential part of managing finances. With its user-friendly interface and instant payment capabilities, Cash App provides a seamless way to make Cash App transfer. Whether sending money to friends or making purchases, knowing how to use this app effectively can save time and enhance your financial transactions. This guide will walk you through various methods to utilize Cash App efficiently in 2025.

Understanding Cash App Payment Methods

Utilizing the right Cash App payment methods is critical for ensuring safe and quick money transfers. Cash App offers several options to send money, each catering to different needs. Among these include bank transfers, linked debit or credit card payments, and even Cash App direct transfer using your Cash App balance. Each method has unique functionalities, benefits, and potential fees. Understanding these is essential for optimizing your money transfers through the application.

Setting Up Your Cash App Account

To begin using Cash App, the first step is to download the Cash App mobile app from your device’s app store. Once installed, you will need to sign up and create an account. During this process, you’ll enter necessary personal information, including your email and phone number. It’s also advisable to implement Cash App two-factor authentication for added security. Users must link a bank account or debit card to ensure that they can access and manage their Cash App balance easily. Once set up, you’re ready to explore the **Cash App sending process**.

Funding Your Cash App for Transactions

Before you can start making payments, it’s crucial to Cash App deposit money into your Cash App account. You can fund your account by linking a bank account, where you can transfer funds instantly. Go to the “Banking” tab, click on “Add Cash,” and enter the desired amount. This money will be available for immediate Cash App money transactions. Understanding how to manage these funds will allow you to make transactions smoothly without delays.

Making Cash App Transfers

Once your account is set up and funded, you can begin making Cash App money transfers. The application allows you to send money to anyone with a Cas App account though their unique username or phone number. Sending money is as simple as navigating to the “Home” screen, entering the amount you want to send, and selecting your payment method. Users should be aware that all Cash App payments are an instant transfer; they typically are completed within seconds but may occasionally take longer depending on your bank.

Using cash App Link Transfer

Cash App link transfer is promising for users who wish to send money securely. You can use the application to send funds directly via a unique Cash App link to others. This option is particularly beneficial for businesses or when requesting money as it reduces the need to share bank details. Simply choose “Request” on your Cash App homepage, and share the generated link to let others send you funds instantly.

Cash App Instant Payment Features

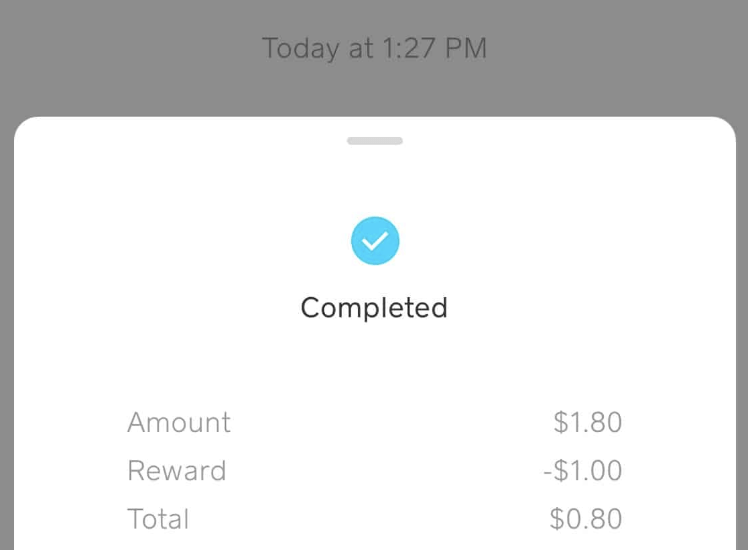

One of the main advantages of Cash App money send is its instant payment feature, allowing users to complete transactions with ease. This functionality comes in particularly handy in times of urgency, like splitting bills with friends after a dinner out or sending immediate financial support to family members. Ensure that you have adequately reviewed any necessary confirmations before completing a Cash App transfer since all money is quickly debited from your account.

Managing Cash App Transaction Limits

As with any financial applications, understanding sending limits on Cash App is vital for effective management. Cash App has a standard limit for both sending and receiving money. Typically, users can send up to $250 within 7 days or receive $1,000 within 30 days before additional verification is necessary. To lift these limits, users are encouraged to verify their identities by providing personal information or uploading relevant documents in the app’s settings, ensuring full access to Cash App funding.

Best Practices for Cash App Usage

Employing best practices helps maintain a secure financial ecosystem while using the app. Regularly monitor your transactions through the Cash App transaction history for suspicious activity, and ensure your device is secure to protect your account from unauthorized access. Utilizing Cash App security features can also safeguard your money transfers against scams and fraudulent activities. Being alert and informed enhances your experience on the platform while ensuring smooth transactions.

Common Issues and Troubleshooting Cash App

It’s common to face certain issues while using online payment services like Cash App. Users might encounter problems with receiving money on Cash App or difficulties linking their bank accounts. It’s prudent to check for any Cash App notifications regarding downtime or service maintenance. For troubleshooting, access the Cash App support service for fast assistance or refer to the Cash App FAQ section for common questions and their solutions.

Conclusion

In closing, sending money digitally through Cash App is a straightforward process that can significantly ease personal finance management in 2025. By understanding the various payment methods and maintaining safety protocols, users can enhance their overall experience while using the app. Whether handling casual transactions or managing more extensive financial responsibilities, Cash App equips you with the tools necessary for a hassle-free money transfer system. Make the most of these capabilities and enjoy the benefits of the Cash App ecosystem!

FAQ

1. How long does a Cash App transfer take?

A Cash App transfer using your linked debit card is almost instant, while bank transfers can take 1-3 business days to complete. Always check your transaction status within the app for updates.

2. Are there any fees associated with Cash App transactions?

Cash App does charge fees for instant transfers and for using a credit card. However, sending money through your Cash App balance or linked bank account is typically free. Be aware of the fee structure before executing any transfer.

3. What should I do if my Cash App payment fails?

If your Cash App payment fails, first check your load balance and internet connection. If everything appears normal, check the Cash App for any notifications regarding outages or downtime that may affect service. Should the issue persist, reach out to Cash App customer support for help.

4. Can I send money internationally with Cash App?

At present, Cash App does not support international money transfers. It is primarily focused on transactions within the United States. For international payments, consider exploring alternative services.

5. How can I safeguard my Cash App account?

To enhance your Cash App account safety, use strong, unique passwords, enable two-factor authentication, and continuously monitor your activity for any unfamiliar transactions. Keeping your app updated regularly can also help strengthen your account