Effective Ways to Calculate Revenue in 2025

Calculating revenue accurately is crucial for businesses looking to optimize their income and understand their financial health. This guide explores various methods to effectively calculate revenue, ensuring that you leverage the best practices for revenue optimization as we move into 2025. Implementing sound revenue strategies today can lead to significant growth tomorrow.

Understanding the Revenue Formula

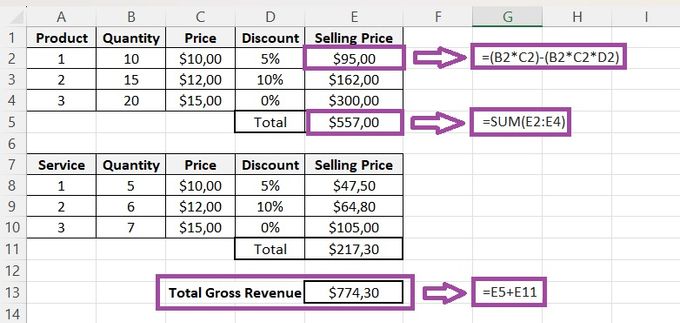

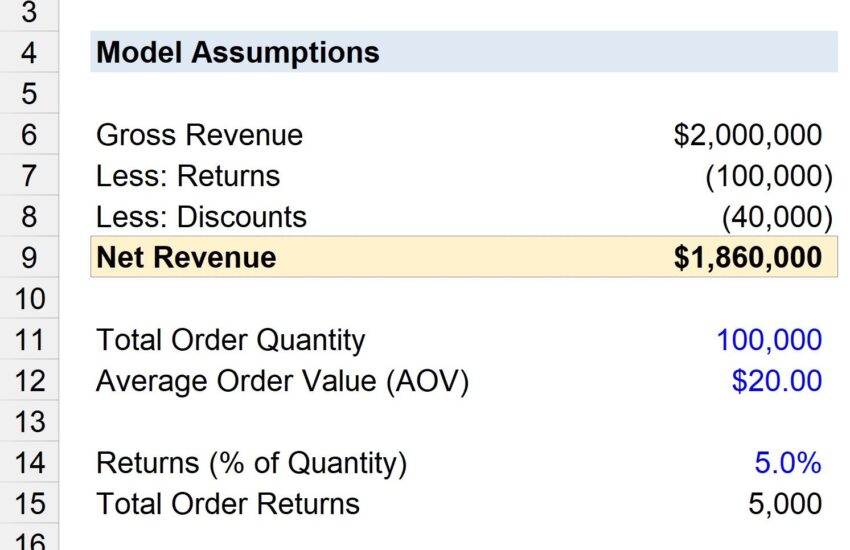

The revenue formula is fundamental to businesses of all sizes. It illustrates how much a company earns from its business activities over a specific period. The basic formula for total revenue is straightforward: Revenue = Price x Quantity Sold. This formula can vary based on whether you’re looking at gross revenue or net revenue, after accounting for returns and allowances which parses down your actual earnings. In 2025, understanding and applying various revenue formulas can bolster your revenue management strategy.

Gross Revenue vs. Net Revenue

To effectively assess your business’s financial position, it’s essential to distinguish between gross revenue and net revenue. Gross revenue includes all earnings before any deductions, while net revenue is what remains after all necessary deductions. For example, if your product sells for $100, and in a month you sell 200 products, your gross revenue is $20,000. However, if you account for $5,000 in returns and allowances, your net revenue would be $15,000. Understanding this difference helps in revenue analysis and enables better financial decision-making.

Annual vs. Quarterly Revenue Calculation

In 2025, businesses should consider both annual and quarterly revenue calculations for better financial forecasting. By evaluating revenue trends over these periods, companies can identify patterns that will search how seasonality affects their revenue sources. For example, a retail business might see a spike in revenue during the holiday season, impacting their annual forecast versus quarterly assessments. Recognizing these trends assists in crafting targeted marketing and revenue generation strategies to capitalize on identified opportunities.

Revenue Growth Strategies

To increase overall business revenue, it is imperative to adopt effective growth strategies. Revenue growth doesn’t occur in a vacuum; it requires an understanding of market behavior and competition. In 2025, companies should focus on utilizing data-driven approaches to enhance their revenue sources and allow for a more strategic revenue model assessment.

Identifying New Revenue Streams

Exploring different revenue streams can significantly elevate your revenue growth potential. A business that diversifies its offerings, such as introducing maintenance agreements with product sales or creating digital content for subscription models, can better insulate itself from market volatility. For instance, companies that opt for a recurring revenue model gain the benefits of predictable income, aiding in better revenue forecasting and management.

Revenue Optimization Techniques

Employing revenue optimization techniques is essential for maximizing your business income. This might include pricing strategy adjustments, bundling products or services, or enhancing customer experiences to drive repeat purchases. Furthermore, analyzing revenue performance through key revenue metrics can shed light on where your business stands and where improvements are needed. Using advanced analytical methods such as revenue impact analysis allows businesses to pinpoint areas of significant opportunity or risk.

Utilizing Revenue Forecasting and Projections

Proactive revenue forecasting is vital to shape your business strategy. Delving into effective revenue projections allows organizations to map their financial future and create impactful revenue management strategies. Look at historical data, market trends, and economic indicators to create robust predictions for your financial outlook in 2025 and beyond.

Creating Accurate Revenue Forecasts

To create reliable revenue forecasts, companies must integrate historical sales data with market analysis. For instance, organizations can use previous years’ financial metrics to determine growth patterns, seasonality, and forecast accuracy. Additionally, using tools like predictive revenue analytics can enhance the reliability of these forecasts by taking external factors into account. Understanding how variations and revenue patterns operate can also significantly improve your long-term revenue planning.

Revising Revenue Strategies As Needed

As you implement your revenue projections, it’s crucial to keep a flexible approach. Economic conditions can change rapidly, necessitating adaptations in revenue strategies. Regularly assess fresh market data to refine your revenue calculations and adjust your projections accordingly. This adaptability will not only help maintain the stability of your revenue stream but also allows your business to seize new opportunities as they arise.

Key Takeaways on Revenue Calculation

Accurate revenue calculation in 2025 demands a dynamic and thorough approach. Key points to remember include:

- Understand the differences between gross revenue and net revenue to make informed decisions.

- Perform both annual revenue and quarterly analysis to identify trends and improve forecasts.

- Diversify your revenue streams for stability and growth opportunities.

- Employ advanced techniques for revenue optimization and performance tracking.

- Stay flexible and ready to revise revenue strategies based on market changes.

FAQ

1. How do I calculate my business income accurately?

To calculate your business income effectively, reliably track all earnings from sales using the revenue recognition principles. This views total income, accounting for returns and allowances, leading to a clearer picture of both net revenue and gross revenue.

2. What methods can I use for revenue analysis?

You can conduct detailed revenue analysis by examining financial reports, year-over-year performance, and identifying key revenue benchmarks. Utilizing digital revenue analytics also provides insights into trends, patterns, and potential revenue improvements.

3. How can I enhance my revenue generation efforts?

Enhance your revenue generation by diversifying products or services, optimizing pricing strategies, and investing in effective marketing efforts. Targeting your existing customer base for upsells and cross-sells is also a proven method for increasing overall revenue.

4. What is the significance of revenue forecasting?

Revenue forecasting is crucial for strategic planning and ensuring financial stability. It allows businesses to anticipate future performance, budget effectively, and make informed operational decisions based on projected revenue outcomes.

5. How can I track my revenue growth over time?

To track your revenue growth, develop a system for consistently documenting revenue reports and comparing them over set periods. Utilizing tools for business revenue tracking, such as revenue metrics dashboards, can also streamline this process, giving you real-time insights into your revenue performance.

6. What are best practices for revenue optimization?

Effective revenue optimization best practices include constant testing and refining of pricing strategies, enhancing customer engagement, and utilizing analytics to inform business strategies. Exploring customer feedback and behavior can also help optimize offerings to maximize revenues.