“`html

How to Properly Calculate Net Sales in 2025

Calculating net sales is crucial for understanding a business’s revenue and profitability. This guide will walk you through the essential concepts, terms, and formulas needed to accurately compute net sales in 2025. By mastering how to calculate net sales, businesses can better strategize for financial success.

Understanding Net Sales Definition

Net sales represents the total revenue from sales of goods or services, minus returns, allowances, and any discounts. It gives a more accurate view of actual revenue than gross sales, which do not account for these deductions. A clear net sales definition is fundamental for understanding financial performance and is widely used in various financial analyses. However, many businesses neglect these deductions, which can lead to inflated revenue reports. In contrast, the net sales metric permits a nuanced perspective, allowing stakeholders to visualize how sales translating into revenue are performing over time. This nuance is why understanding net sales is pivotal in accounting practices across various industries.

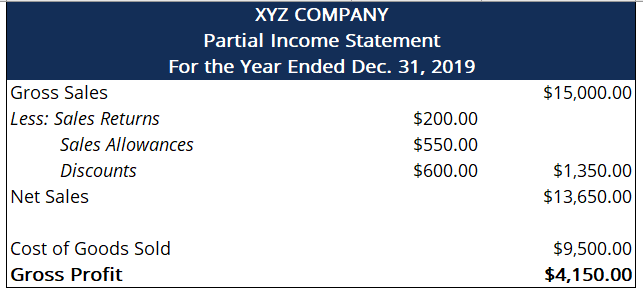

The Key Net Sales Formula

To compute net sales, businesses can utilize the straightforward formula: Net Sales = Gross Sales – (Sales Returns + Allowances + Discounts). This formula accurately reflects sales revenue by accounting for all necessary deductions, ensuring a precise depiction of a company’s transactions. For example, if a company has gross sales of $100,000, returns of $5,000, allowances of $2,000, and discounts totaling $3,000, the calculation would be: $100,000 – ($5,000 + $2,000 + $3,000) = $90,000. Therefore, the net sales amount to $90,000, providing a much clearer idea of the revenue generated from actual customer purchases.

Importance of Net Sales

The importance of net sales in the financial context cannot be understated. It influences various financial metrics like profit margins, revenue estimation techniques, and sales forecasting. For instance, analyzing net sales trends offers insights into customer behavior and market demands. This aids businesses in making informed decisions about inventory management and pricing strategies. A concrete grasp of net sales metrics is critical for financial analysis, enabling companies to discern critical patterns not visible through gross sales metrics. Thus, tracking net sales over time can uncover significant opportunities for growth, helping businesses to avoid pitfalls.

Calculating Net Sales for a Business

In the world of finance, calculating net sales for a business is vital for proper financial reporting. Unlike gross sales which give a broad picture, net sales allow businesses to evaluate their customer return policies and price-setting strategies. Understanding net sales is especially tough for newcomers; however, with consistent calculations based on the formula provided earlier, it can become comfortable. Overall, this understanding aligns with accounting principles and bolsters businesses’ financial performance over time.

Steps to Calculate Net Sales

To effectively calculate net sales and ensure accuracy, here are a few critical steps:

- Begin with the total gross sales figure.

- Deduct any returns made by customers to calculate net revenues.

- Account for any allowances made, such as damaged products not returned.

- Subtract discounts that have been provided to customers from your gross sales.

- Resulting in a clear picture of net sales.

By thoroughly following these steps to calculate net sales, businesses can enhance their financial statements net sales accuracy, leading to better-informed operational strategies in the future.

Understanding Net Sales in Retail

In the retail sector, understanding net sales is significantly different due to the high volume of transactions and varying customer behaviors. Here, net sales in retail not only accounts for product returns and discounts but also seasonal sales adjustments that are integral during holiday periods. Retail businesses should also consider the impact of sales returns on net sales, employing robust tracking systems to analyze this fluctuation accurately. Accurate reporting standards are crucial, as they ensure that the business aligns its strategies with real-time consumer behaviors.

Net Sales Analysis and Its Impact on Profits

Dissecting net sales analysis includes close examination of how these sales figures affect overall profit margins. A business experiencing a decline in net sales may hint at several issues such as market saturation, ineffective pricing, or uncompetitive items. Consequently, an in-depth analysis can expose potential weaknesses within the sales functions and guide necessary adjustments to bolster financial health.

Effects of Sales Returns on Net Sales

Particularly in sectors with high customer return rates, the effects of sales returns on net sales are considerable. Tracking these returns allows businesses to adjust their inventory levels and improve their pricing models accordingly. For instance, if a retailer observes a recurring pattern of returns for specific products, it might indicate quality issues or misalignment between customer expectations and actual offerings.

Net Sales Impact on Profits

The correlation between net sales and profitability is often overlooked, but it is crucial. A detailed understanding of this relationship arms management with the insights needed for revenue growth strategies. As net sales are directly tied to various expense factors, decreasing them impacts overall cash flow. Financial metrics for sales performance hinge upon maintaining desirable net sales, ultimately influencing business longevity.

Key Takeaways and Conclusion

Mastering net sales calculations is integral for any business aiming to optimize its financial health. By accurately reflecting revenue generation, these metrics enable sound decision-making and foster a competitive edge. With insights into reading financial statements, companies can enhance their earnings trajectories, build sustainable practices, and bolster profitability.

FAQ

1. What is the difference between net sales and gross sales?

The key difference lies in how returns, allowances, and discounts are deducted from gross sales to calculate net sales. Gross sales consider all transactions without adjustments, while net sales provide a clearer view of actual revenue.

2. How do sales adjustments impact net sales?

Sales adjustments like discounts and returns drastically affect the total amount reported as net sales. Monitoring these factors allows for better capital management and revenue estimation techniques.

3. How are net sales reported in financial statements?

Net sales are reported as the top line on the income statement, highlighting the total revenue earned after accounting for deductions. This figure is critical for analyzing the company’s financial health.

4. Why is understanding net sales important?

Understanding net sales allows businesses to gauge their revenue, assess the effectiveness of pricing strategies, and influence profitability. It provides insights for strategic decisions and long-term planning.

5. Can you provide an example of net sales calculation?

Sure! If a company has $200,000 in gross sales, $20,000 in returns, and $10,000 in discounts, the net sales calculation would be: $200,000 – $20,000 – $10,000 = $170,000 in net sales.

6. What strategies can improve net sales?

Effective sales forecasting, tailored promotions, adjusted pricing strategies, and enhanced customer service can significantly improve net sales by boosting sales volume and customer retention.

7. How do companies track net sales over time?

Companies typically track net sales by analyzing monthly reports, employing accounting software for precision, and comparing fiscal year outcomes to see trends in revenue generation and growth.

“`