How to Properly Fill a Check: Essential Tips for 2025

Learning how to fill out a check is a fundamental skill everyone should possess. Whether you’re managing personal finances or running a business, being able to correctly write a check is crucial. In this guide, we will explore essential tips that will help you master the art of written checks in 2025.

Understanding Check Format

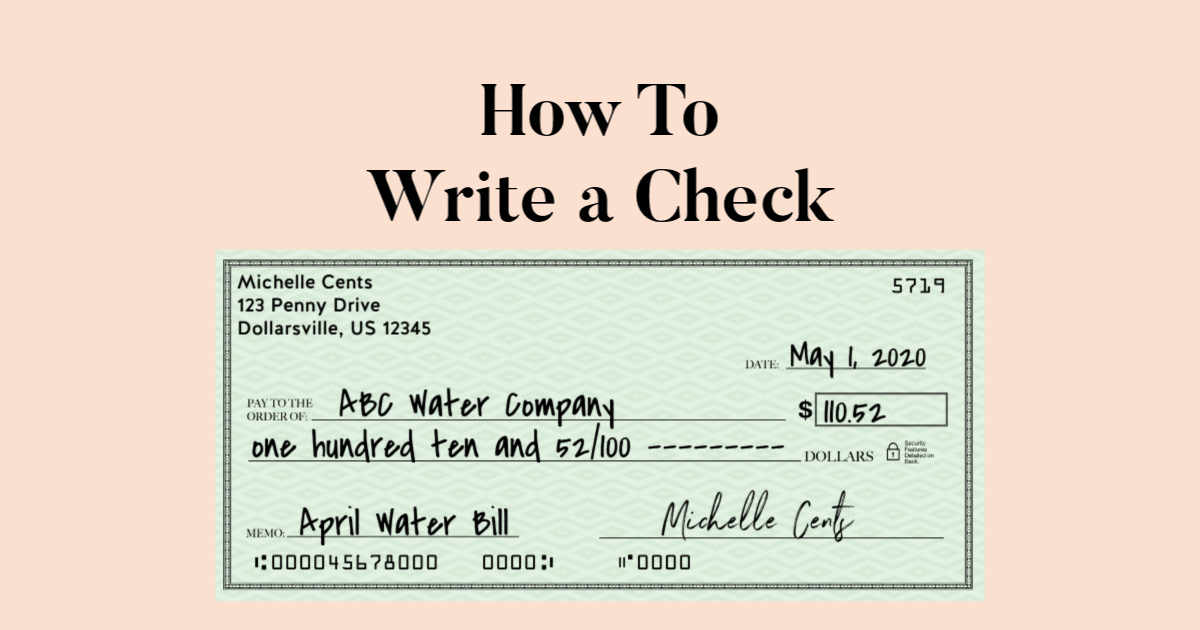

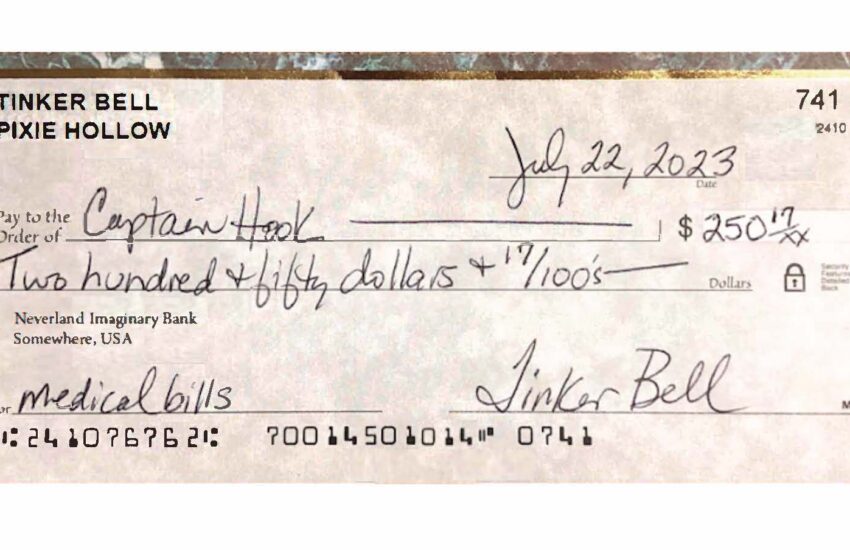

The first step in written checks is understanding the check format. A check typically contains several important sections: the date, the recipient’s name, the amount in numbers and words, a memo line, and your signature. Each of these components serves a purpose and must be filled out correctly to avoid errors. For example, the date should reflect when the check is issued. This date is critical for proper record-keeping and can impact the check cashing process.

Step-by-Step Guide on Fill Out a Check

To effectively fill out a check, follow these steps:

- **Date:** Write the date in the top right corner. This is when the check is issued.

- **Payee:** Write the full name of the check recipient next to “Pay to the order of”. Make sure the spelling is correct.

- **Amount in Numbers:** Fill in the amount you are paying in the small box on the right. Ensure this matches what you write in words.

- **Amount in Words:** Write out the amount in words on the line below the recipient’s name. This serves as a verification.

- **Memo:** Optionally, include a note about the payment.

- **Signature:** Sign your name on the line at the bottom right, as this authorizes the check.

By following these steps carefully, you can avoid common mistakes associated with check errors.

Common Check Mistakes to Avoid

When it comes to written checks, mistakes can lead to significant issues like payment delays or disputes. Therefore, it’s essential to be aware of the typical pitfalls. One common mistake is incorrect amounts. Ensure that the numbers and words match; otherwise, banks may default to the written amount. Another error to avoid is forgetting your signature. Without it, the check is invalid. Additionally, be cautious of leaving your check blank bypassing the check handling instructions, which can lead to unauthorized usage.

Check Writing Tips for Success

Mastering the check writing process requires understanding best practices, especially for those who regularly engage in business check writing. Here are some crucial check writing tips that will enhance your effectiveness:

Safety When Writing Checks

Your security is vital when it comes to handling checks. Always use a pen with permanent ink to fill out your checks to prevent alterations. Avoid leaving blank checks in unsecured places, as it exposes you to potential fraud. Regularly monitor your check transactions to ensure there are no unauthorized payments. Establish clear check policies if you’re handling checks on behalf of a business, as this provides a structure for secure transactions.

Understanding Bank Policies for Checks

Different banks have varying check cancellation policies** and check cashing processes. It’s worthwhile to familiarize yourself with your bank’s policies, particularly regarding stale or post-dated checks. Knowing bank policies for checks will better inform you of how they handle discrepancies or disputes if they arise.

Supporting Checks: Endorsing and Depositing

<pOnce you’ve filled out a check, you may need to endorse it for cashing or depositing. Knowing **how to endorse a check** allows for smooth transactions.

How to Endorse a Check

Endorsing a check is straightforward. On the back of the check, write your signature. If you’re transferring the check to someone else, include “Pay to the order of [Recipient’s Name]” followed by your signature. Be aware of your bank’s rules on check deposit requirements, as disregarding them may complicate the clearing process.

Check Types and Their Uses

Understanding the different check types is essential for effective check processing. Personal checks are common for everyday transactions, while business checks often have additional security features. Different types also include cashier’s checks and traveler’s checks, with each meant for specific needs. It’s important to choose the right check type based on your transaction needs to avoid complications.

Key Takeaways

- Understand the check format and fill out each section correctly to avoid errors.

- Follow the right steps to fill a check and be cautious of common mistakes.

- Prioritize security when writing checks by using permanent ink and monitoring your transactions.

- Be familiar with your bank’s check cashing process and policies to handle issues effectively.

- Know the requirements for endorsing and transferring checks to ensure smooth financial transactions.

FAQ

1. What is the best way to avoid check errors?

The most reliable way to avoid check errors is to double-check all details before issuing a check. Ensure that the amounts, date, and signatures are accurate. Additionally, use a consistent format for your checks.

2. Can I write a check without a payee?

No, a check must have a designated check recipient for it to be valid. Leaving this field blank can result in unauthorized encashment.

3. What happens if I forget to sign a check?

Without your signature, the check is considered void. You will need to write a new check with your signature to allow the payee to cash it.

4. Are there different types of checks I should know about?

Yes, understanding various check types is crucial. Common types include personal checks, business checks, and cashier’s checks, each serving different purposes.

5. What should I consider before accepting a check?

When accepting a check, consider its legitimacy. Verify the check verification steps followed by checking the payer’s bank and history to minimize the risk of fraud.